Bitcoin (CRYPTO: BTC) is trading mildly up to $103,000 on Thursday, showing almost little relief even after Washington ended its 43-day shutdown.

Extreme Fear Dominates Despite Policy Clarity

Crypto Fear & Greed Index (Source: Coinglass)

Bitcoin's fear index fell to 14, matching panic levels from earlier capitulation events this year.

The reading signals that traders remain risk-averse even as Washington resolves political gridlock.

Historically, the end of major U.S. political standoffs sparks relief rallies across equities and digital assets.

This time, Bitcoin barely reacted, reflecting deep investor caution and ongoing structural weakness.

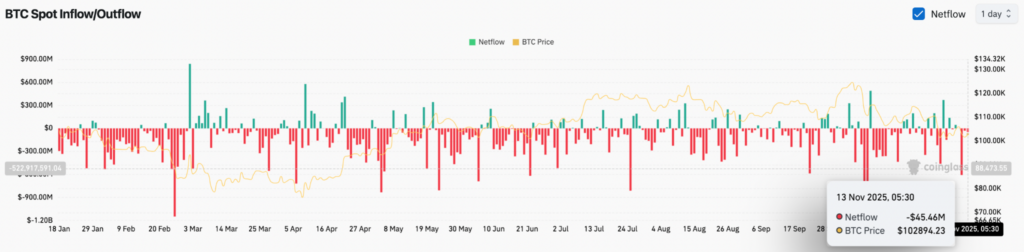

$45 Million Bitcoin Outflows Show Big Money Still Running For Safety

BTC Netflows (Source: Coinglass)

CoinGlass data shows another $45 million in net outflows on Nov. 13, extending a multi-week pattern of steady red prints.

Since mid-October, most sessions have recorded withdrawals from exchanges, signaling weak confidence among institutional traders.

Even with political risk easing, investors continue to move funds off exchanges rather than position for upside.

Chart Shows Fragile Support Near $100,000

BTC Price Analysis (Source: TradingView)

Bitcoin trades below its 20-, 50-, and 100-day EMAs, clustered between $105,900 and $110,600.

The 200-day EMA near $107,800 has flattened, suggesting that long-term momentum is fading.

Parabolic SAR still sits above price, confirming the ongoing short-term downtrend.

A reclaim of the descending trendline near $106,000 would mark the first sign of stabilization.

Failure to hold the $100,000–$102,000 band could open downside toward $98,000 or even $96,500.

For bullish confirmation, BTC must close above the 20-day EMA and sustain momentum toward $110,000.

That zone aligns with the 100-day EMA and prior supply region, where multiple rallies failed earlier this month.

Read Next:

- From Azure Darling To Momentum Dog: C3.ai’s Plunging Score Signals Partner Risk

Image: Shutterstock