Shares of Krispy Kreme Inc (NASDAQ:DNUT) are surging Wednesday, lifted by a wave of renewed retail investor interest in meme stocks.

- DNUT is delivering impressive returns. Stay ahead of the curve here.

What To Know: The rally gained momentum Wednesday as traders focused on constituents of the Roundhill Meme Stock ETF (NYSE:MEME), where both Krispy Kreme and Beyond Meat are holdings.

Beyond Meat has seen its stock soar over 600% this week following its inclusion in the ETF and an expanded partnership with Walmart, creating a halo effect for other companies in the fund.

Adding to the bullish sentiment, Krispy Kreme is executing an international expansion. The company successfully opened its first location in Spain on October 2, with plans for more than 50 shops across the country in the next four years.

Further growth is slated for Brazil and Uzbekistan before the end of 2025. This positive operational news, combined with the speculative trading momentum, has created a perfect storm for the doughnut maker’s stock.

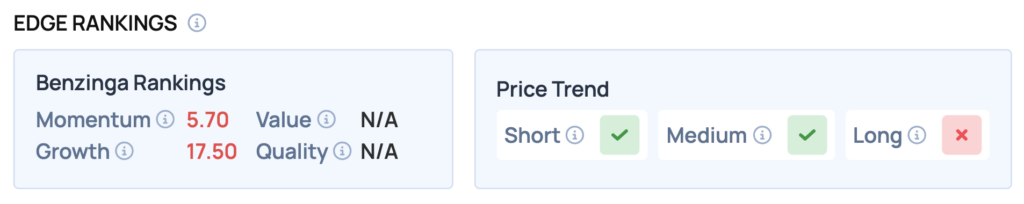

Benzinga Edge Rankings: Underscoring the company’s volatile 2025, Benzinga Edge rankings give DNUT a low Growth score of 17.50.

DNUT Price Action: Krispy Kreme shares were up 8.9% at $4.04 at the time of publication on Wednesday, according to Benzinga Pro data.

Read Also: What’s Going On With Six Flags Stock Wednesday?

How To Buy DNUT Stock

By now you're likely curious about how to participate in the market for Krispy Kreme – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of Krispy Kreme, which is trading at $4.21 as of publishing time, $100 would buy you 23.75 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock