Gold has surged to unprecedented levels in early September 2025, breaching $3,500 per ounce and gaining 37% year-to-date, as investors respond to economic risks, central bank moves and a growing crisis of trust in U.S. institutions.

- GLD ETF trades at record highs. Check live chart here.

What's Happening?

Gold is on a historic tear. Prices have reached record highs above $3,500 per ounce, rising in seven of the past eight trading sessions as of Sept. 5.

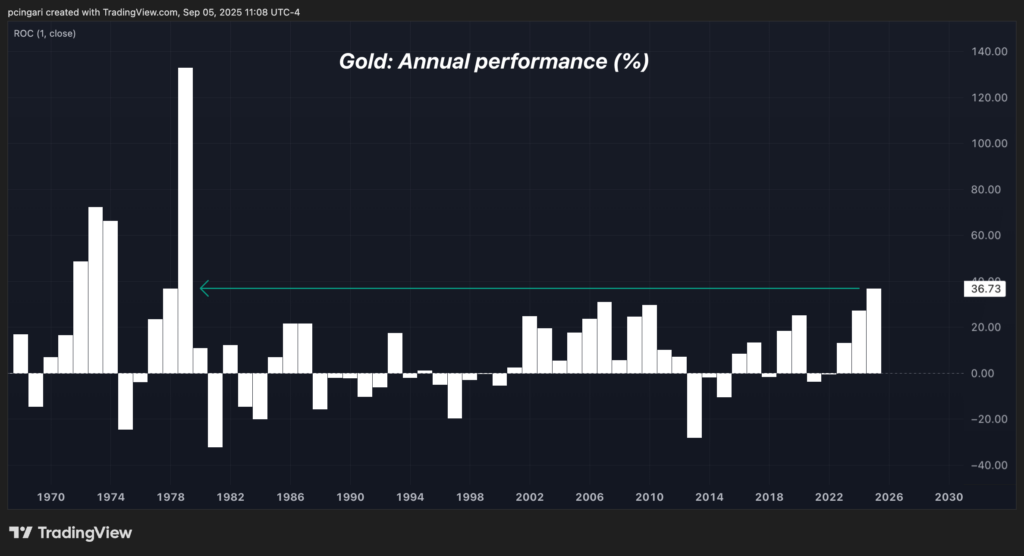

So far in 2025, the yellow metal has climbed 37%, making this its best annual performance since 1978.

Tracking gold's explosive rally, the SPDR Gold Shares (NYSE:GLD), the world's largest gold-backed ETF, has pulled in $11.3 billion in inflows this year--putting it on course to surpass its 2020 record of $15.2 billion in inflows. Similarly, the iShares Gold Trust (NYSE:IAU) has attracted $6.64 billion in inflows – the highest since 2010.

For context, 1978 saw gold skyrocketing 132% amid runaway inflation and weakening confidence in the U.S. dollar--a period that helped cement the metal's role as a hedge against monetary instability.

Chart: Gold’s 2025 Rally Was Unseen In Nearly Half Of A Century

Why does it matter?

This is more than just a commodity rally.

Gold's sharp rise starts to reflect deep unease across financial markets. Traditionally seen as a safe haven, gold becomes more attractive when faith in fiat currencies, central banks or governments is shaken.

Investors appear increasingly concerned about long-term economic stability, political volatility, and the potential erosion of the U.S. dollar's credibility.

Crucially, this rally isn’t only about interest rate expectations. According to Goldman Sachs analyst Samantha Dart, the real gold driver now is political credibility.

In a recent report, she said that gold is gaining ground not just as a hedge against inflation, but as a hedge against institutional breakdowns and the potential weakening of the Federal Reserve's independence.

Who's driving the move?

Several major forces are at play. Retail and institutional investors are piling into gold as protection against global economic uncertainty, spurred by President Donald Trump's aggressive tariffs policy and skyrocketing U.S. government debt.

Central banks have continued buying gold at a historic pace, particularly emerging market economies seeking to diversify their reserves away from the U.S. dollar.

Gold plays a vital role in central bank reserves due to its unique combination of safety, ease of conversion to cash, and long-term value preservation--aligning with the core investment priorities of monetary authorities.

Since Russia's dollar reserves were frozen in 2022, central bank gold purchases have increased fivefold, according to the latest IMF data.

Gold now accounts for 21.7% of total central bank reserve assets worldwide, with global central banks collectively holding 36,359 metric tonnes, according to data from International Finance Statistics.

Last but not least, fears are mounting that the Federal Reserve could come under political pressure from the Trump administration, raising concerns that its interest rate decisions might prioritize political goals over inflation control.

What's the backstory?

Gold's current rally began in late 2023, when markets saw the end of Federal Reserve rate hikes as inflation was trending lower.

Because gold doesn't generate income, it tends to perform better when interest rates fall.

But what began as a monetary story quickly expanded into a broader flight to safety. As geopolitical risks multiplied, and as financial sanctions became more common, central banks started loading up on gold--especially in Asia and the Middle East.

In parallel, investors have grown more skeptical of traditional policy tools and are looking for assets that can store value without relying on government credibility. Gold fits that role.

Unlike bonds or currencies, it doesn’t carry counterparty risk or depend on institutional trust. For this reason, it tends to shine brightest when the global order looks uncertain.

While earlier discussions focused on rate cuts, today's conversation centers on whether U.S. institutions, particularly the Fed, can remain independent in the face of political pressure.

Is the Fed independence at risk?

Mounting tensions between the White House and the Federal Reserve have driven much of the latest investor demand for gold.

President Donald Trump has openly criticized the central bank for not cutting rates fast enough, questioned Jerome Powell's legitimacy as chair and even floated the idea of dismissing him ahead of the natural end of his term in May 2026.

Following the resignation of Fed Governor Adriana Kugler, Trump’s appointment of Stephen Miran to the Fed's Board--while Miran retains his role as chair of Council of Economic Advisers--has fueled further concern about political interference.

The situation escalated in August, when Trump attempted to fire Fed Governor Lisa Cook on disputed mortgage allegations, marking the first such move against a sitting board member in the institution's 112-year history and sparking an ongoing legal battle that could reach the Supreme Court.

What could happen next?

Gold's trajectory will depend heavily on U.S. politics and monetary policy.

If the Federal Reserve is perceived to be yielding to political influence, investors may accelerate their move out of U.S. Treasuries and into gold.

According to Goldman Sachs, even a small reallocation--just 1% of private Treasury holdings shifting into gold--could lift prices to $5,000 per ounce.

Goldman Sachs's $4,000 baseline target for gold by mid-2026 assumes steady central bank buying and rising demand from emerging markets. But in a more extreme "tail-risk" scenario--such as a major loss of credibility for the Fed--prices could break through $4,500.

The path forward also hinges on whether central banks continue their current pace of gold accumulation. So far, there are no signs of slowing, especially from countries looking to hedge against Western financial dominance.

Additionally, if global trade routes remain under threat and geopolitical tensions stay elevated, demand for physical gold could rise further.

Still, there are downside risks.

A stabilizing political landscape, firmer economic growth and a clear commitment to central bank independence could remove some of the urgency to buy gold. Rising real yields would also make non-yielding assets like gold less attractive.

The bottom line

Gold's record-breaking rally in 2025 is not just about lower interest rates or inflation fears--it's about a global shift in confidence.

With investors questioning the durability of institutions, the direction of U.S. politics, and the safety of fiat currencies, gold has reasserted itself as the ultimate insurance asset.

Unless those concerns ease, the move toward $4,500--or even $5,000--may still be just beginning.

Read now:

- Bad Jobs Data Just Dropped--And Wall Street Smells Rate Cuts Coming