Amazon.com Inc (NASDAQ:AMZN) stock is down Tuesday afternoon amid overall market weakness. The decline is being driven by a sharp increase in U.S. Treasury yields, which is hurting high-growth tech stocks. Investors are worried that higher interest rates will lower the value of these companies.

What To Know: The sell-off in growth sectors is directly linked to the ascent of the 10-year Treasury yield, which climbed to 4.29%. For companies like Amazon, which are valued based on the promise of robust future earnings, higher yields on government bonds present a significant headwind.

As the “risk-free” rate of return on Treasuries increases, the discount rate used to calculate the present value of future cash flows also rises. This, in turn, reduces the current valuation of stocks that are expected to generate a large portion of their profits in the future.

Read Also: What’s Going On With Nvidia Stock?

This dynamic makes growth stocks less appealing compared to the safer returns offered by government bonds. Investors on Tuesday are likely recalibrating their portfolios in response to this shift, leading to a flight from high P/E stocks.

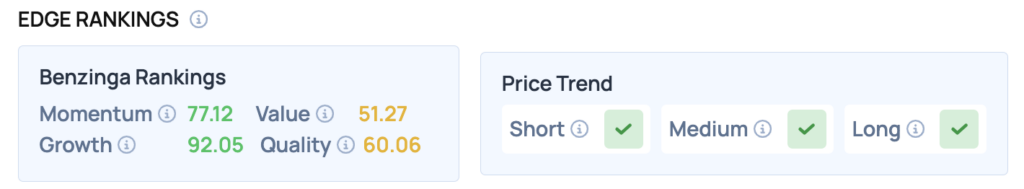

Benzinga Edge Rankings: Underscoring its profile as a premier growth company, Benzinga Edge stock rankings award the stock an impressive Growth score of 92.05.

Price Action: According to data from Benzinga Pro, AMZN shares are trading lower by 1.59% to $225.36 Tuesday afternoon. The stock has a 52-week high of $242.52 and a 52-week low of $161.43.

Read Also: August’s 20 Most-Searched Tickers On Benzinga Pro – Where Do Opendoor, Palantir, BitMine Immersion, Apple Stock Rank?

How To Buy AMZN Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Amazon’s case, it is in the Consumer Discretionary sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock