A big economic question right now: To what degree does today's economic activity reflect a pull forward of purchases that would've occurred further down the road?

One of the actions some companies have taken to mitigate the impact of future tariffs has been to pulling forward expected future purchases and stockpiling goods before costs go up.

Various anecdotes from companies and a spike in imports at the beginning of this year suggest this pull-forward could be significant. Here are some notable quotes from Q1 earnings season:

"Our clients are getting ready. We’re seeing some accelerating of imports to stockpile inventories." – Citigroup

"Looking outside the U.S., demand for U.S. inbound services surged as customers pull forward inventory purchases ahead of expected tariff changes." – UPS

"For transparency, you will see that we did build ahead inventory, and that’s reflected in our manufacturing purchase obligations that you’ll see on the quarterly filing when it comes out." – Apple

"We’ve done some forward buys of inventory where we’re the first-party seller. Our third-party sellers have pulled forward a number of items, so they have inventory here as well." – Amazon

"We built some inventory where possible in certain items as we anticipate that to happen. So that gives a little relief of amounts needed to in some of the items. But the impact should be mostly concentrated in the second half." – Kraft Heinz

"As a precaution, we’ve taken steps to build inventory in certain markets to mitigate potential tariff impact in the short term." – WD-40

So how much extra stuff did companies stockpile?

Different analysts will give you different answers.

';About 1 to 2 months' ⏳

Deutsche Bank's Binky Chadha analyzed the data to estimate how much extra inventory companies have accumulated.

It's not much.

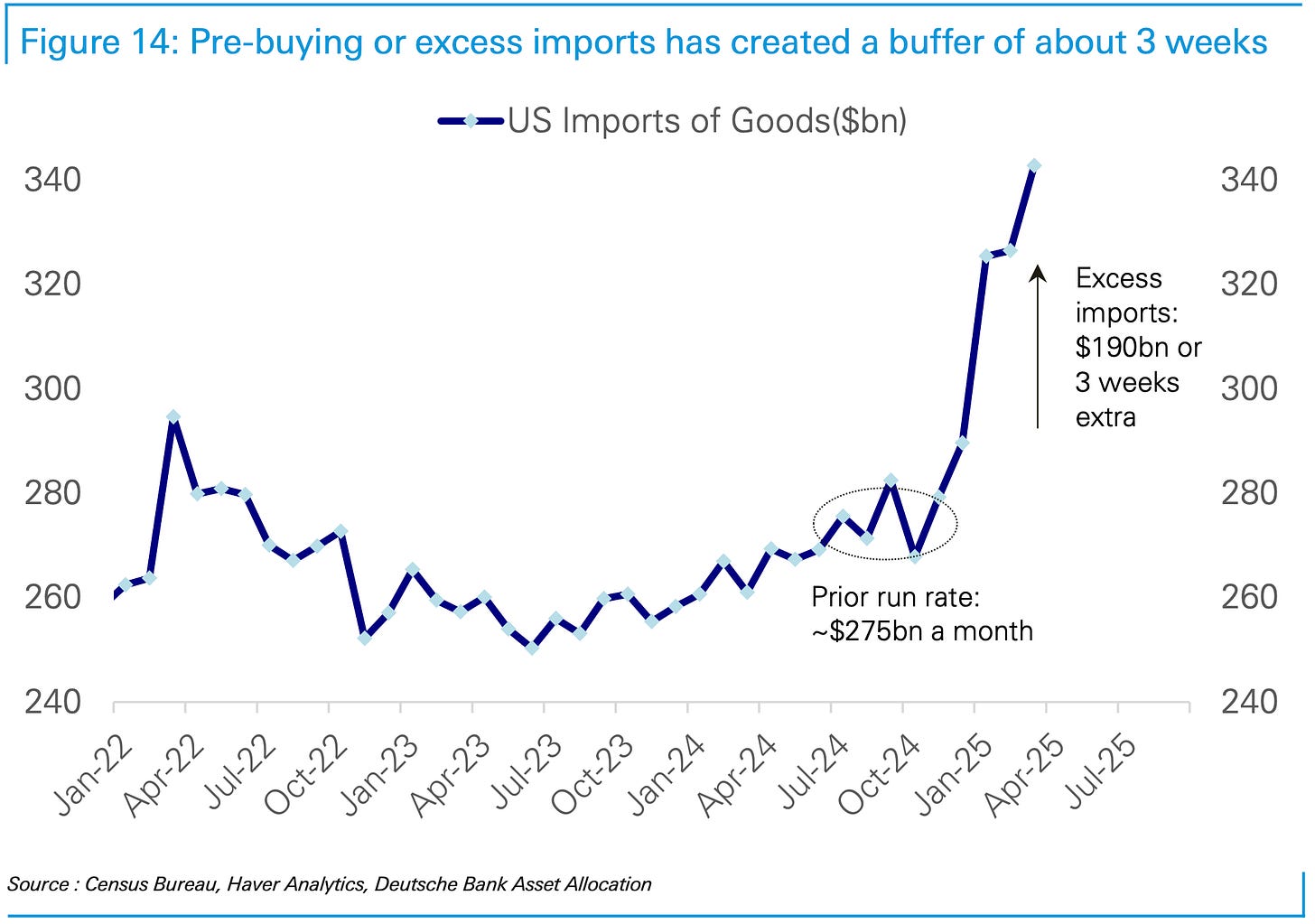

"In clear evidence of pre-buying, goods imports surged in Q1, especially in March, but relative to the prior run rate of $275bn a month, we estimate the excess imports over the last 3 months were about $190bn, or around 3 weeks extra," Chadha wrote in his May 2 research note.

The way companies manage inventory has changed in recent years.

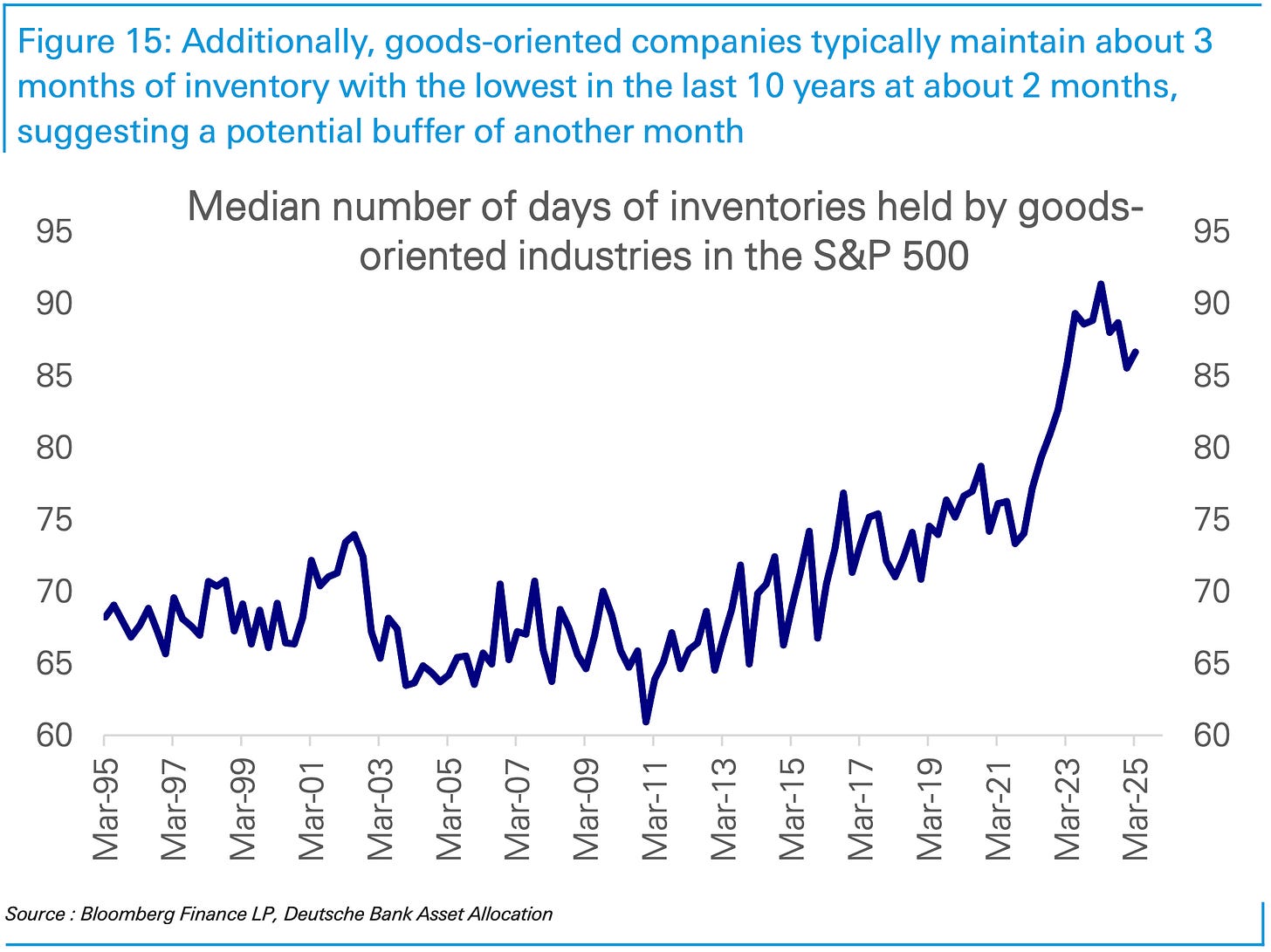

"Companies typically maintain about 3 months of inventory," Chadha wrote. "They have been raising that buffer over the last 10 years, especially since the COVID pandemic supply chain disruptions, and the lowest levels in the last 10 years have been about 2 months, which suggests companies could run their buffers down for a month at most in hopes for a tariff reprieve."

In other words, companies were already carrying extra inventory before President Trump unveiled his aggressive view on tariffs.

So while Chadha's estimate of "about 1 to 2 months" of buffer for S&P 500 companies is arguably significant, it doesn't even buy a quarter's worth of time.

Some analysts think it's less ⌛️

In a separate analysis of retailer inventories, BofA analysts expressed skepticism toward the idea that warehouses are well stocked. From their note (emphasis added):

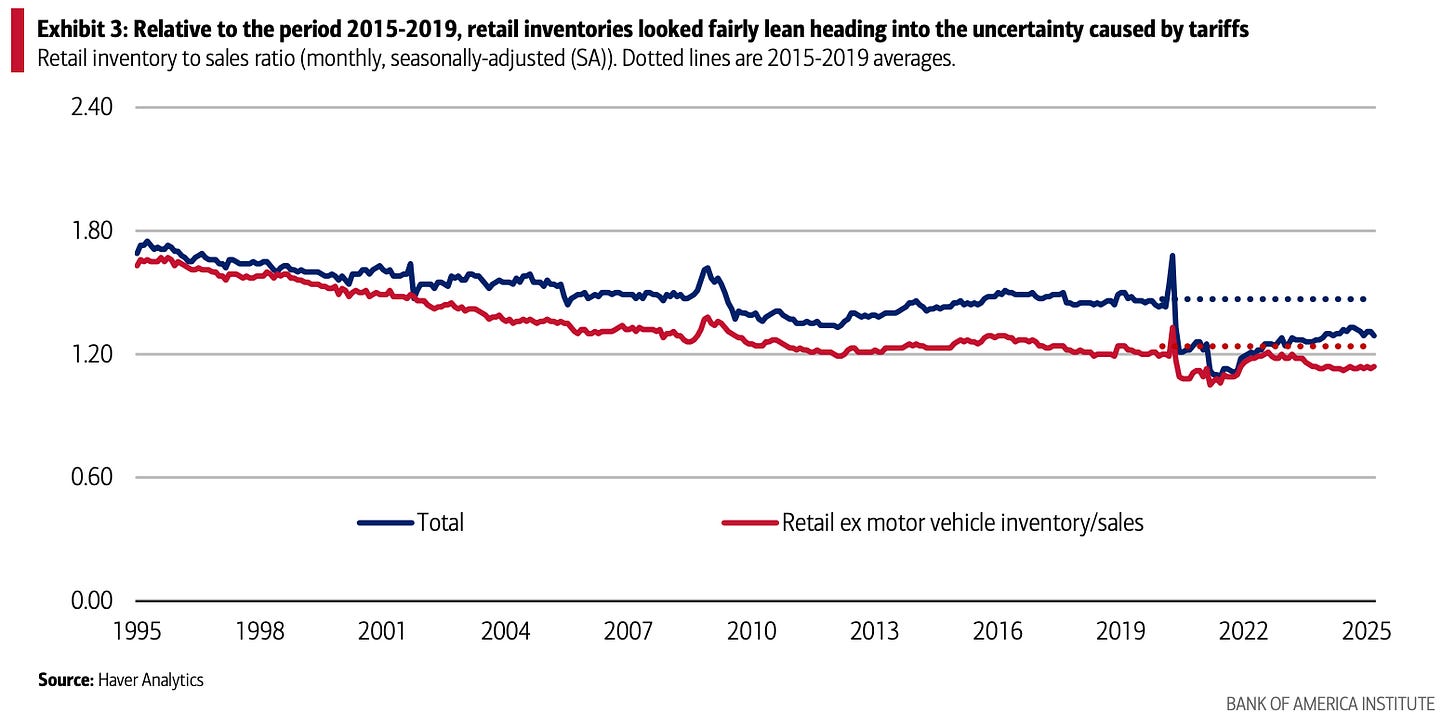

"There was a surge in imports of consumer goods into the U.S. in March, according to Census Bureau data. Does this mean retailers’ inventories are set to swell? In our view, no. The ratio of retailers’ inventories to their monthly sales was not especially high in recent data to begin with. And at the same time, consumers also appear to have been buying ahead, with Bank of America internal data showing strength in consumer durables spending in March and April. Moreover, Bank of America internal data on retailers’ payments to transportation and shipping companies does not suggest a big ramp up in inventories. And it appears container shipments into Los Angeles are likely down in May. So we think it is possible retail inventories may actually look ‘lean’ in coming months."

It's worth noting that the most recent retail inventories data from the Census only goes through February. So those particular figures are a bit stale.

That said, BofA makes a good point about consumers "buying ahead." This suggests that a lot of goods left warehouses as quickly as they came in. This is consistent with government data on consumer spending, which has been very strong.

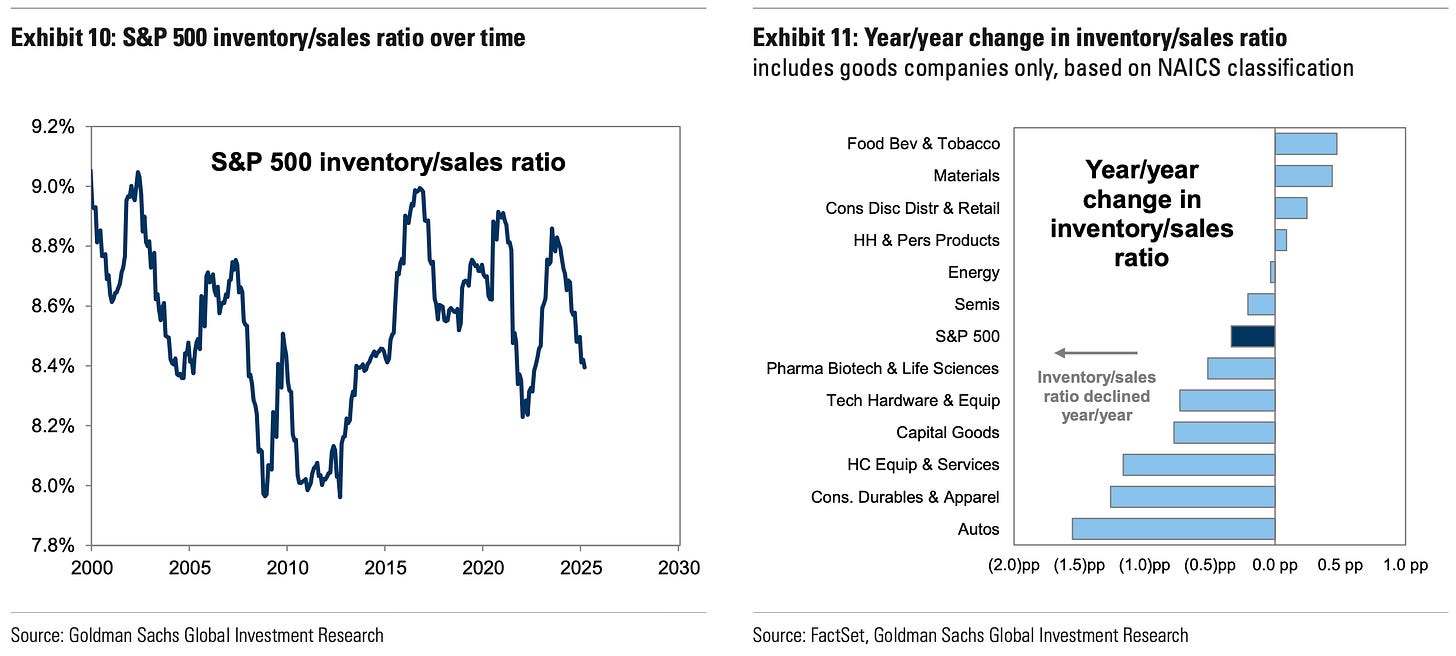

Goldman Sachs' David Kostin analyzed the S&P 500 and came to a similar conclusion.

"1Q data do not show a buildup of inventories," Kostin wrote on Friday. "The S&P 500 inventory to sales ratio declined year/year, with the largest declines in the Autos and Consumer Durables & Apparel industries. However, many retailers have yet to report 1Q results."

The March retail sales report showed an unusual spike in autos sales, which supports the idea that consumers pulled forward purchases to front-run tariffs.

To Kostin's point about fresh data, retailers will be announcing their Q1 results in the coming weeks. On Thursday morning we get Walmart's earnings. That day also comes with the April retail sales and March inventories reports. Everyone will be watching for clues about inventory builds as well as how much inventory was cleared out by sales pulled forward.

Zooming out 🔭

Even if we had a more clear understanding of inventory levels, the bigger issue continues to be the uncertainty around tariffs.

If we ultimately get very high tariffs, then inventory stockpiling would've been a good move. If any new tariffs are low, then inventory stockpiling could prove to be a costly error.

There's also the possibility that proposed tariffs or any tariff deals continue to get delayed, and this uncertainty nightmare persists.

The big picture 🖼️

These are uncertain times.

The economic data is sending ambiguous signals. Managers are having an unusually hard time forecasting the near future for the businesses. And investors and analysts are having an unusually hard time modeling where stock prices are headed in the coming months and quarters.

It's periods like this where long-term investors have an edge: Time.

"Nobody knows what the market is going to do tomorrow, next week, next month," Warren Buffett said last week. But as he often does, he argued, "The long-term trend is up."

There's basically three scenarios investors always have to consider: 1) Things improve from here, and the market goes up; 2) Things get worse before they get better, which means markets could fall before resuming a more firm rally; or 3) Things get worse and never get better.

If we're facing scenario 3, then we may have bigger problems than stocks not recovering. But scenario 3 has never played out.

Scenarios 1 and 2 favor long-term investors. Maybe things get worse before they get better. (Note: Timing market bottoms is nearly impossible.) But staying long the stock market covers you in case the low of this cycle is behind us.